1. The Shift: Why On‑Chain Perps Are the New Frontier

In traditional DeFi, derivatives often live in hybrid or semi‑on-chain models: off‑chain matching, on‑chain settlement, oracles bridging data, etc. These models carry trust, latency, and centralization trade‑offs.

What’s happening now: perpetual contracts (perps) are being reimagined to run fully on-chain—order matching, clearing, liquidations, funding, everything—on a blockchain that can sustain the throughput and latency requirements. That’s what Hyperliquid is doing.

Why does this matter?

Trust & transparency: Every order, cancellation, and trade is visible and auditable

Non‑custodial everything: You never hand off execution to a centralized engine

Composable strategies: Smart contracts, bots, protocols all operate in the same ecosystem

Global liquidity: Liquidity flows cross chains more easily when the core execution is on-chain

Deflation of friction: No reliance on API keys, relayer backends, or bridging delays for each trade

In short, on-chain perps is not just a novel architecture, it’s a foundational shift for derivatives.

2. Hyperliquid’s Architecture: L1 Built for Derivatives

Hyperliquid isn’t just another EVM chain. It’s built from the ground up to host derivatives:

- It runs a native order book engine at Layer 1: all matching, clearing, and liquidations are intrinsic to the chain, not a soft layer. This eliminates many off-chain trust components.

- Through HyperEVM, developers can deploy contracts that directly interact with perp state (orders, margins) in real time.

- The chain supports gasless or zero‑gas order actions (for trading operations), placing, canceling, and modifying orders occur via signed messages rather than EVM gas.

- Blocks and consensus are optimized for high throughput and low latency so that order execution feels fluid and reactive.

- The architecture ensures cancel‑first / priority ordering, so when you cancel or adjust an order, you are not executed mid‑cancellation.

This combination of speed, native derivatives logic, and programmability is unique. Many other “DEX perps” still rely on sequencers or off-chain matchers; Hyperliquid internalizes it.

3. Market Traction: Volume Explodes

The transition isn’t theoretical: volume tells the story.

In the past 12 months, Hyperliquid has passed $1.57 trillion in on-chain perpetuals traded.

Its 30‑day perp volume is ~$279B (and 24h perp volume ~ $5.59B) per DefiLlama metrics.

It is becoming one of the leading DEX derivatives venues, competing with dYdX and others.

These numbers show that traders are already trusting this architecture and that the volume frontier is moving on-chain.

4. The Weakness of Hybrid & Off‑Chain Models

Before full on-chain perps, many platforms used hybrid models, off-chain matching, oracles, or rollups. Their bottlenecks:

- Centralized matching engine risks: black boxes, uptime, censorship

- Latency delays: every round-trip from the off-chain engine adds lag

- Bottleneck on scaling: off-chain matchers saturate

- Limited composability: cross-strategy or smart contract interplay is awkward

- Trust bridges: if part of the system is off-chain, users must trust operators

When you compare, a fully on-chain model avoids many of these. That’s why the future of perps is on-chain and why Hyperliquid is positioning itself as the backbone.

5. Coinrule as the Intelligence & Automation Layer

Even with on-chain perps, a blockchain is not a strategy engine. That’s where Coinrule fits in: it’s not just an automation tool, it becomes the intelligence layer on top of the execution substrate.

What role does it play?

- Strategy logic/signal detection: technical indicators, cross-market triggers, on-chain signals

- Order execution logic abstraction: rather than writing bots, you define rules (IF/THEN)

- Risk control overlays: stop-loss, position limits, replacement constraints

- Non‑custodial execution: you keep the keys, Coinrule sends signed calls

- Cross-pair / multi-strategy orchestration: manage many strategies under one roof

In effect, the stack is:

Hyperliquid (L1 perp engine)

↑

Coinrule (limits.trade, rule execution)

↑

Your strategies (signals, filters)

With such alignment, you can treat Hyperliquid like a programmable derivatives substrate and build modular strategies atop it.

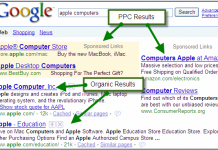

6. How limits.trade Realizes Strategic Execution on Hyperliquid

One of Coinrule’s flagship features, limits.trade, is essential for making strategy logic effective in an on-chain perp world.

What does it do?

- Places adaptive maker-only limit orders (never market-taking)

- Supports chase / replace logic: if price drifts, cancel + reissue within buffer

- Prevents you from losing liquidity advantage by getting bumped into taker roles

- Integrates with your rule logic (entry/exit/safety) seamlessly

- Because Hyperliquid order actions are gasless, limits.trade can run many updates without cost drag

This feature aligns perfectly with on-chain perps. You want orders that stay maker‑eligible, adapt as the market moves, and don’t incur gas or slippage penalty limits.trade is built for that.

7. Sample Use Cases: Trading Strategies That Thrive On‑Chain

Let’s ground these ideas in real strategies that benefit from the combined architecture.

7.1 Maker Rebate Farming

Place competitive maker orders, capture rebates, and rotate positions often

Because order updates are gasless and on-chain, you can scale quoting intensity

limits.trade ensures you remain a maker and adapt pricing automatically

7.2 Momentum / Breakout Bots

Detect price breakouts via signals, enter with maker-limit entry

Let limits.trade chase the breakout edge without crossing into taker territory

Use trailing exits or safety rules layered via Coinrule

7.3 Hedged Overlays or Pair Spreads

Open offsetting positions (long one, short another)

Automate rebalancing, risk adjustment, and hedges all within the same chain

On-chain perp world simplifies cross-instrument risk logic

7.4 Cross‑Protocol / Cross‑Chain Arbitrage

Spot a divergence between Hyperliquid perp and a DEX perp

Bridge + execute via limits.trade to close spread

Do it quickly thanks to on-chain speed and automation

These are not pipe dreams, they’re in active development in many quant desks. On-chain execution lowers barriers.

8. Risk, Latency & Protocol Considerations

No system is perfect. Be aware:

- Smart contract bugs/protocol upgrades can introduce risk

- Oracle manipulation can distort perp pricing

- Liquidity constraints in exotic tokens may lead to slippage

- High-frequency quoting still needs robust hardware and RPC architecture

- Bridge/deposit/withdraw mechanics (fund ingress/egress) might lag

- Rule misconfiguration or logic bugs can lead to cascading losses

Always ensure fallback rules, safety checks, and monitoring.

10. Roadmap & Future Evolution

Here’s where things are heading:

- Higher-level primitives: strategy modules, built-in quant strategies, AI tuning

- Cross-chain collateralization directly from chains into Hyperliquid

- On-chain portfolio instruments (indexed or derivative tokens) built inside Hyperliquid

- Institutional gateways connecting CEX flows into on-chain perps

- Governance & community strategy libraries built as smart rule packs

- Deeper integration with analytics, on-chain TL (Trade Limit) metrics, sentiment signals

The infrastructure is growing, so strategy differentiation will matter more.

11. How to Get Started Today

If you want to be ahead, here’s a practical path:

1. Set up a Hyperliquid wallet and fund it (via bridge, e.g., Across)

2. Connect Hyperliquid in Coinrule (via wallet signing, no APIs)

3. Build a simple strategy rule using limits.trade: e.g., momentum entry + trailing exit

4. Test in small size, monitor fills, latency, and replacement behavior

5. Add risk rules: position caps, stop-loss, replacement limits

6. Iterate: tune chase buffers, execution thresholds, hybrid overlays

7. Scale by adding more strategies or pairs

You don’t need thousands of dollars to begin. The architecture works with moderate capital, what matters is discipline and system design.

12. Conclusion & Strategic Takeaway

The future of perpetual derivatives is moving on-chain, and Hyperliquid is building that backbone. But infrastructure alone does not create strategy. That role is filled by automation, intelligence, and composability. This is where Coinrule, and especially its limits.trade feature becomes critical.

When you combine:

- Hyperliquid’s high-speed, natively on-chain matching

- Gasless per-order operations

- Coinrule’s modular rule engine

- limits.trade’s adaptive, maker-first execution

You get a derivatives stack that can rival institutional engines without custodial risk or white-label black boxes.

Start building your strategy with Coinrule now